As the impacts of climate change become increasingly evident, the global push for climate finance has gained unprecedented urgency. This movement aims to mobilize substantial financial resources to support climate mitigation and adaptation efforts worldwide. Understanding the driving forces behind this push, the challenges it faces, and the potential solutions is crucial for achieving meaningful climate action.

The Importance of Climate Finance

Climate finance refers to financial investments directed towards reducing greenhouse gas emissions and enhancing resilience to climate impacts. It encompasses funding from various sources, including governments, multilateral institutions, private investors, and philanthropic organizations. The significance of climate finance can be summarized in several key areas:

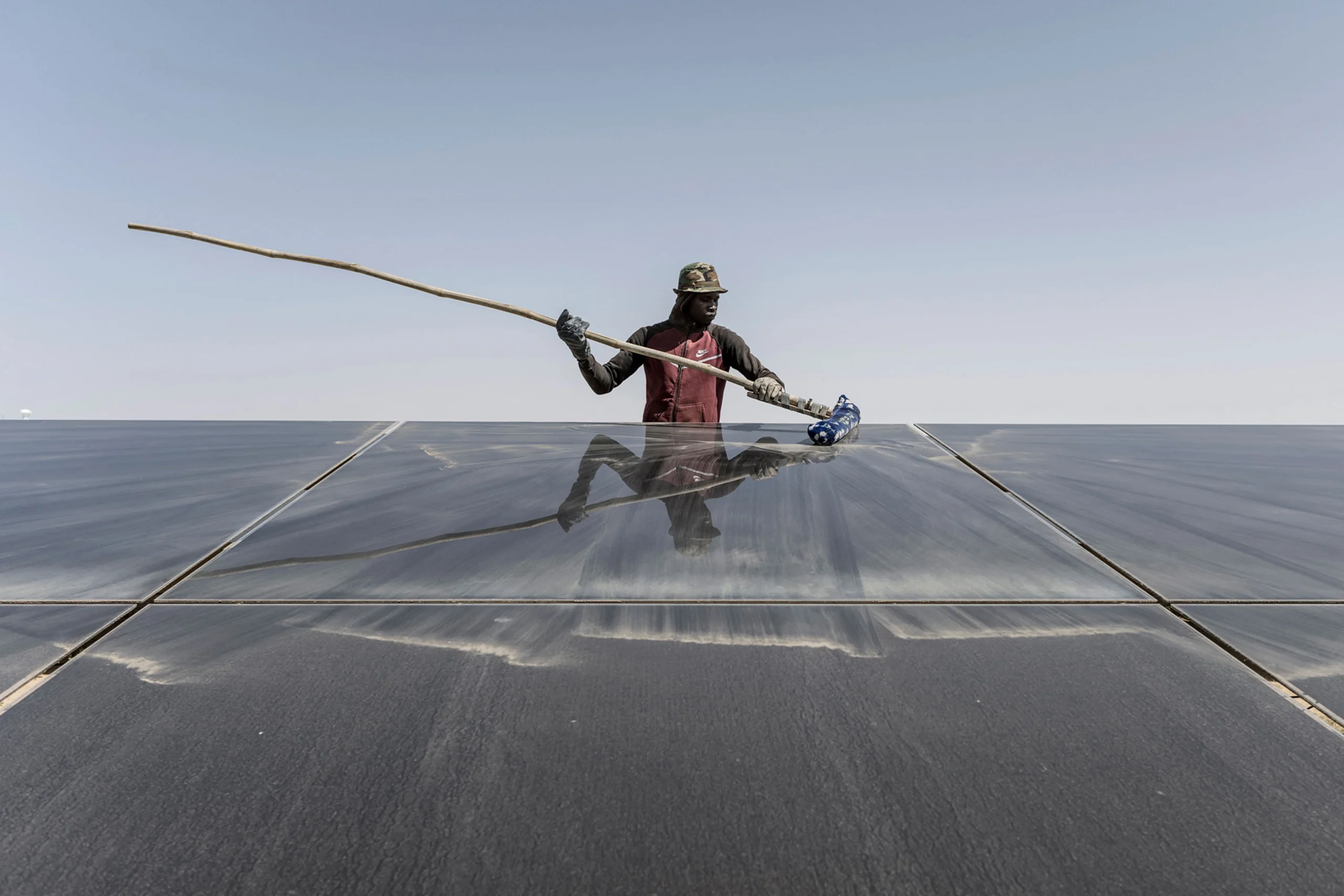

- Mitigation Efforts: Climate finance supports projects aimed at reducing emissions, such as renewable energy initiatives, energy efficiency upgrades, and sustainable transportation systems. These investments are essential for limiting global warming to well below 2 degrees Celsius, as stipulated in the Paris Agreement.

- Adaptation Strategies: For communities facing the immediate consequences of climate change, such as extreme weather events, flooding, and droughts, climate finance is critical for implementing adaptation strategies. These can include building resilient infrastructure, enhancing water management systems, and developing climate-smart agriculture.

- Supporting Vulnerable Populations: Developing countries, which often lack the resources to combat climate change, are disproportionately affected by its impacts. Climate finance is vital for providing these nations with the necessary tools and support to mitigate risks and build resilience.

Driving Forces Behind the Global Push

Several factors are propelling the global push for climate finance:

- International Agreements: The Paris Agreement set ambitious climate targets, necessitating a significant increase in climate financing to support nations in meeting their commitments. Regular climate summits, such as COP meetings, serve as platforms for countries to reaffirm their financial pledges.

- Growing Awareness of Climate Risks: The rising frequency and intensity of climate-related disasters have heightened awareness of the urgent need for climate action. Governments, businesses, and civil society organizations are increasingly recognizing the economic risks posed by climate change and the importance of investing in sustainable solutions.

- Investor Interest in Sustainability: There is a growing trend among investors to prioritize sustainable and socially responsible investments. This shift is creating new opportunities for climate finance, as private capital seeks to align with environmental, social, and governance (ESG) criteria.

Challenges to Climate Finance Mobilization

Despite the urgent need for climate finance, several challenges hinder its effective mobilization:

- Funding Gaps: Current climate finance levels fall short of the estimated trillions needed annually to combat climate change. Bridging this gap requires coordinated efforts from both public and private sectors.

- Complex Funding Mechanisms: The landscape of climate finance can be complex, with various funding sources and mechanisms that may be difficult for developing countries to navigate. Streamlining processes and improving accessibility is essential.

- Political Will and Commitment: Political instability and changing government priorities can impact the continuity of climate finance commitments. Sustaining long-term investments in climate initiatives is crucial for achieving lasting impacts.

Moving Forward: Solutions and Strategies

To effectively advance the global push for climate finance, several strategies can be implemented:

- Strengthening Multilateral Cooperation: Enhancing collaboration between countries, multilateral development banks, and international organizations can facilitate the flow of climate finance to where it is needed most.

- Innovative Financing Models: Developing new financing mechanisms, such as blended finance, impact investing, and green bonds, can mobilize additional resources from the private sector and philanthropic organizations.

- Capacity Building: Providing technical assistance and capacity-building support to developing countries can empower them to access climate finance effectively and implement projects that align with their national priorities.

Conclusion: A Collective Responsibility

The global push for climate finance represents a collective responsibility to address the urgent challenges posed by climate change. As nations work together to mobilize financial resources, the emphasis must be placed on supporting vulnerable populations, promoting sustainable development, and enhancing resilience to climate impacts. By understanding the dynamics of climate finance and actively participating in this movement, stakeholders can contribute to a more sustainable and equitable future for all.